Share this

The Ultimate Report on Beauty and Cosmetics Consumer Trends in 2019

by Infegy Research Team on August 26, 2019

Natural. Organic. Healthy.

These terms now drive buying habits in all types of consumer goods markets. Nowhere is this more evident than in the beauty, cosmetics, and hygiene industries.

The data is clear: natural beauty is the best beauty in 2019 and beyond.

Our social insights report for the beauty industry is your official guide to the latest consumer trends in the beauty and cosmetics industry.

What do people want most in their beauty products? What are their favorite brands and which brands do they trust most? What are the biggest reasons they buy? And which beauty brands are missing out on opportunities to reach their customers?

The report reveals fascinating, never-before-seen data that answer these very questions and more.

Read on to see the biggest takeaways from our report-- and click here to download it now!

Takeaway 1: Beauty Brands Face Challenges to Meet Changing Consumer Preferences

What’s one thing we know when a consumer trend is established?

Competition is fierce!

Everyone is chomping at the bit to get in on the action. Someone starts an electric scooter share service, and a week later the city streets are littered with little motor scooters from different companies.

Now that it’s out in the open, it seems all beauty companies are looking to prove to consumers that they are the best option to meet their natural beauty needs.

But when you have have accurate social intelligence data in your hands, you can find the social proof these brands seek.

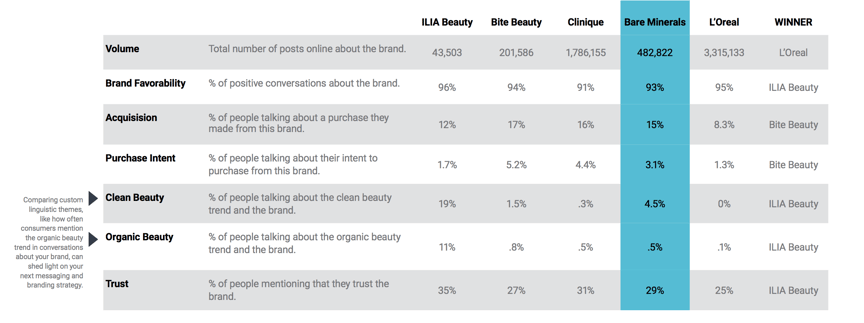

Here, you see which brands lead in specific conversational metrics and categories amongst consumers:

Big name brand L’Oreal drives more audience conversations, with 3+ million posts found in our sampled analysis.

But it’s ILIA Beauty that tallied the most top performances in our analysis. They won out in social listening metrics like brand favorability and brand trust, meaning that consumers discuss them more positively and they express trust in the brand when they discuss them.

ILIA also beats the other brands in our custom audience segments for “organic beauty” and “clean beauty”, signaling that they are the leading voice within these categories.

As you’ll see in the report, this is becoming a difficult industry break through on. The chart above highlights beauty brand Bare Minerals, which pioneered natural beauty products, but doesn’t lead in any of the social listening metrics.

Download the report to see how the rest of the brands stack up and why.

Takeaway 2: K-Beauty Sensation Shows Consumers Desire for Trendy or Cheaper Products

Even when you don’t qualify as part of the hottest trend, if you can find a way to be trendy in other ways, people will gravitate to you.

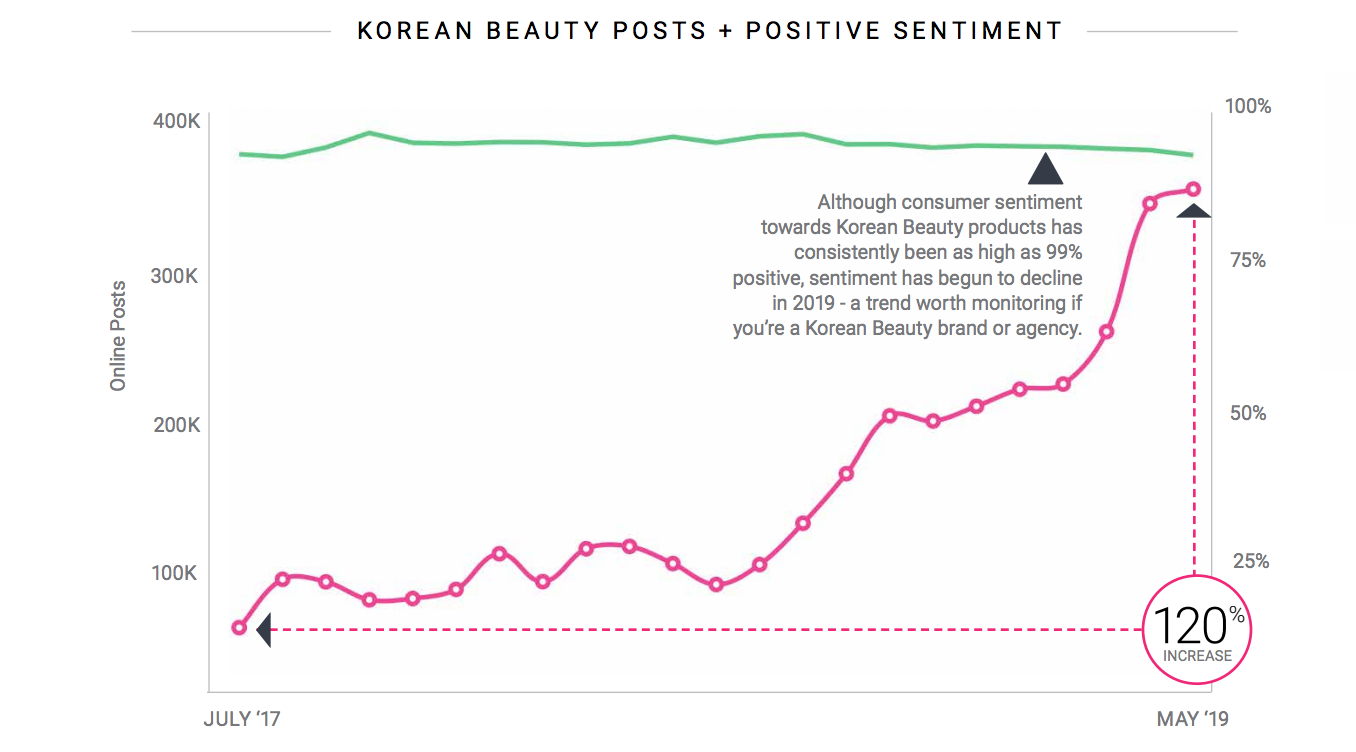

One big trend highlighted in our report that exemplifies this is Korean Beauty, or K Beauty.

K Beauty products are trendy because, 1) they are inexpensive and 2) Korea is known as an innovative disruptor in the area of cosmetics. Many people associate beauty and cosmetic products from Korea as being better quality.

And the popularity of the K Beauty fad is clear. Just look at that pink line representing online conversation volume since 2017:

Inside the report, you’ll see emotional analysis to see which emotions consumers express when discussing K beauty, as well as the most popular K Beauty products according to consumer analysis. Get your copy here.

Takeaway 3: Consumers Shape Dialog Differently Across top Social Networks

When you discuss products you love online, where do you turn? Does it change depending on the specific subject or topic?

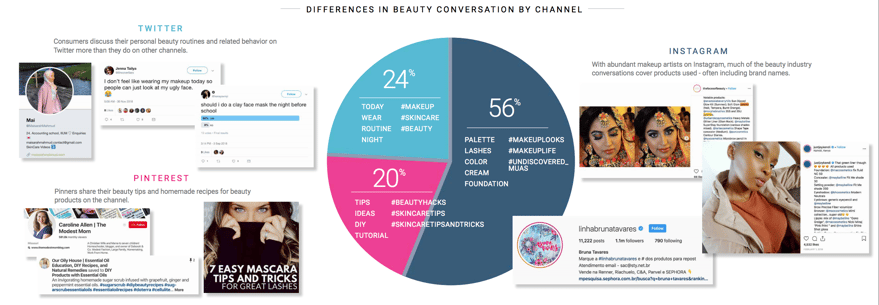

We discovered during our research that different audiences turn to different channels for discussing their beauty routines, ideas and brands and products they love.

This makes sense. A network like Twitter is the ideal place to talk about what you’re up to. Pinterest on the other hand is a natural channel to share ideas, recipes and DIY.

So, if you’re an analyst for a beauty brand looking to understand consumer trends in your market, a social listening tool capable of filtering and searching by channel can you help you analyze these audiences and their online habits.

Here, you see which topics different types of consumers discuss depending on the channel:

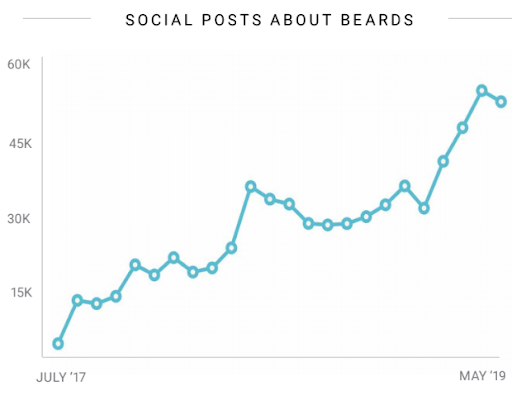

Beauty brands don’t just appeal to women. Men are looking for more natural products as well.

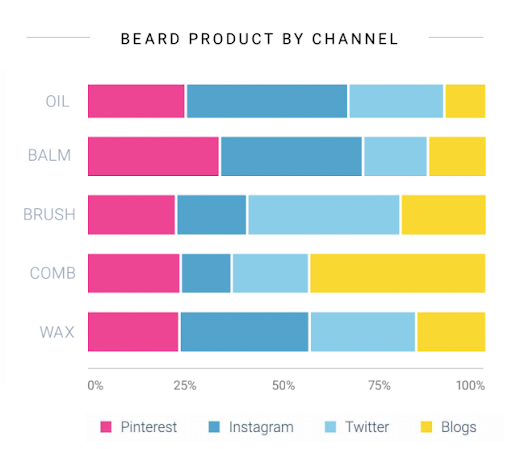

Analysis of men’s grooming segments show which products drive consumer conversations and where they talk about them. Consider the topic of beards. Beards are back! They’ve been back. And interest in them is only growing:

The demand for more natural, less processed men’s grooming products shows that that this idea that healthy, organic ingredients have become mainstream for all types of consumers.

Using social listening, as we did in our report, you can break down the different products mentioned by social channel:

Our research underscores how it’s important to consider both the medium and the message when researching your target audiences online.

Conclusion

The lesson here is this: consumers of all types and backgrounds are rapidly changing their preferences and their expectations for their beauty products and routines.

One of the things driving this evolution is social media trends and influencers who push new and innovative natural products online.

People care about what they consume and put in (or on) to their bodies. Chemicals and ingredients with long names will absolutely turn people away. What’s more, claiming that the product is free of these insidious materials will push people to make a choice.

As consumers ramp up their engagement on these conversations surrounding natural products, your beauty brand can leverage the right social intelligence technology to analyze and understand the changing market.

Download the beauty industry report to see the latest beauty and cosmetic trends and learn how these insights can help your team today!

Share this

- April 2024 (1)

- March 2024 (3)

- February 2024 (3)

- January 2024 (2)

- December 2023 (3)

- November 2023 (4)

- October 2023 (3)

- September 2023 (3)

- August 2023 (4)

- July 2023 (4)

- June 2023 (3)

- May 2023 (4)

- April 2023 (4)

- March 2023 (4)

- February 2023 (4)

- January 2023 (1)

- December 2022 (3)

- November 2022 (4)

- October 2022 (3)

- September 2022 (3)

- August 2022 (2)

- July 2022 (1)

- June 2022 (1)

- April 2022 (1)

- March 2022 (1)

- January 2022 (1)

- December 2021 (1)

- November 2021 (1)

- October 2021 (1)

- June 2021 (1)

- May 2021 (1)

- April 2021 (1)

- March 2021 (1)

- February 2021 (1)

- January 2021 (2)

- November 2020 (1)

- October 2020 (2)

- September 2020 (1)

- August 2020 (2)

- July 2020 (2)

- June 2020 (2)

- April 2020 (1)

- March 2020 (2)

- February 2020 (2)

- January 2020 (2)

- December 2019 (2)

- November 2019 (1)

- October 2019 (1)

- September 2019 (2)

- August 2019 (2)

- July 2019 (2)

- June 2019 (1)

- May 2019 (2)

- April 2019 (1)

- March 2019 (2)

- February 2019 (2)

- January 2019 (1)