Share this

Dollar Tree's Successful Price Increase and Brand Impact

by Henry Chapman on September 21, 2022

Measuring brand impact of a business pivot

Dollar Tree’s contentious business pivot

Dollar Tree has successfully executed a contentious business pivot without negative impact to its brand value.

This brief surveys reasons behind the pivot as well as customer responses that reveal that ultimately, the pivot was a successful venture that did not negatively impact Dollar Tree’s brand.

Dollar Tree reacts to changing economy

Dollar Tree, founded in 1953, started selling items for $1 in 1986. At the time, it was mostly popular in the eastern parts of USA, but it grew by acquiring a series of smaller dollar store chains across the US. Until recently, it was one of the last stores chains operating under the “everything’s a dollar” motto.

Responding to long-developing supply chain constraints, Dollar Tree took a massive business pivot in November 2021: the chain raised prices of most goods to $1.25 per item.

Dollar Tree’s need to pivot

Economic conditions make pre-existing prices untenable

While the company publicly denied that the price increases were due to inflation, economists point out that economic conditions were the impetus for the price raises – more specifically, supply chain constrictions. Dollar Tree faced down unprecedented supply shocks in 2020. Their business, primarily grocery and dry goods, was particularly affected by the logistic bottlenecks associated with international shipping backlogs. The price-hikes were necessary to keep the business viable.

Figure 1: News Article Explaining That Dollar Tree’s Pronouncement That Price Move Was Not Due To Inflation. Many economists doubted their reasoning.

Results of the pivot

Dollar Tree’s price increases represented a tremendous risk for a company that staked its entire identity on keeping prices steady at $1.00. However, Dollar Tree reported a 30.1% earnings per share growth in Q2 2022. Additionally social listening data shows overall Dollar Tree sentiment is just short of it’s all time high positive sentiment score.

Figure 2:Dollar Tree Sentiment over the last three years. Note the drop in sentiment when price increase was announced.

Why Dollar Tree’s pivot worked

Low competition for a niche customer-base

Dollar Tree has found a niche in places where consumers cannot rely on traditional grocery stores e.g, very rural communities or urban food deserts. Therefore, Dollar Tree didn’t lose customers with the pivot since their customer-base has limited purchasing options.

Figure 3: Maps showing Dollar Tree locations (left) and Dollar Tree post volume locations on Infegy Atlas (right)

1. Net positive online sentiment

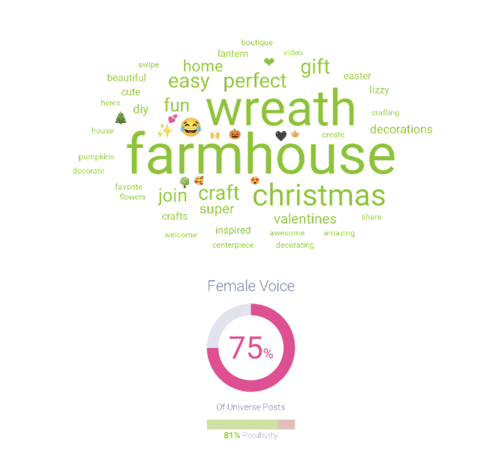

Infegy Atlas shows the vast majority social conversation around Dollar Tree comes from middle-aged women interested in crafting. People post frequently about Dollar Tree’s craft supplies, DIY offerings, and affordable holiday decorations.

Around 75% of the conversation around Dollar Tree was dominated by female voices. Analyzing the conversation before and after the pivot, these female voices speak about the brand positively 81% of the time.

Figure 4: Positive female post volume along with female crafting-related topics

2. Net positive online sentiment (continued)

In November 2021, the month Dollar Tree announced the price increase, the percentage of men talking about Dollar Tree doubled, while the percentage of women talking about the chain was cut in half. Those men, on average, were 20% less likely to speak about the brand positively during their conversation. This would be alarming except, looking at conversations over the 3 years, data reveals this share of male audience to be atypical for the brand.

Also crucial, Dollar Tree’s female share of conversation returned to the mean shortly after the price increase, suggesting that negative conversation was temporary, and didn’t pose lasting damage to the brand.

Figure 5: Male vs. female post volume. Note the increase in male post volume when price increase was announced

3. Demographics of Dollar Tree’s critics

Examining Channel Distribution provides further evidence of non-traditional post volume: Pinterest typically houses 84% of the Dollar Tree conversation. After the price increase, conversation spiked on Twitter, representing critics hopping on Twitter to discuss their displeasure. This Twitter share of was not only atypical for social conversation around Dollar Tree, the conversation was predominantly male while the typical conversation on Pinterest represented a predominantly female voice. Furthermore, shortly after the after the price hikes were implemented, Pinterest’s share of Dollar Tree conversation returned to normal.

Figure 6: Post volume distribution by social media channel. Note, when the price increase was announced, Twitter conversation increased while Pinterist post volume decreased

Conclusion

Examining a successful business pivot

Dollar Tree took a risk by altering a fundamental part of their business. They succeeded, as shown by the growing stock price and earnings per share. Dollar Tree’s pivot worked because their rural and urban customer base didn’t have a lot of alternative shopping options. Additionally, unprompted and unfiltered online conversation reveals a net positive sentiment from Dollar Tree’s typical conversants (those who discussed Dollar Tree prior to the pivot, as well as after). While Infegy data showed possible threats to user sentiment and brand perception, those setbacks proved to be temporary, and online conversation quickly returned to the mean.

Key Takeaways from Dollar Tree's Price Raise

Successful Business Pivot: Despite its contentious nature, Dollar Tree's decision to raise prices to $1.25 in November 2021 proved successful, with no lasting negative impact on its brand.

Economic Necessity: Price hikes were driven by supply chain constraints and economic conditions, ensuring business viability amidst logistical challenges.

Positive Financial Outcome: The pivot led to a significant 30.1% earnings per share growth in Q2 2022, highlighting its financial success.

Limited Competition: Dollar Tree maintained its customer base, particularly in rural and urban food deserts, where shopping options are scarce.

Dominant Female Support: Online sentiment remained positive, with 81% of conversations led by middle-aged women focusing on crafting and affordable products.

Temporary Negative Sentiment: Although male criticism surged briefly on social media, the typical female-dominated conversation returned to normal, minimizing any long-term brand damage.

Platform-Specific Conversations: Criticism was mostly voiced on Twitter, while positive conversations about Dollar Tree remained strong on Pinterest.

Share this

- December 2025 (2)

- November 2025 (2)

- October 2025 (3)

- September 2025 (2)

- August 2025 (2)

- July 2025 (3)

- June 2025 (3)

- May 2025 (4)

- April 2025 (2)

- March 2025 (1)

- February 2025 (4)

- January 2025 (1)

- December 2024 (2)

- November 2024 (2)

- October 2024 (4)

- September 2024 (2)

- August 2024 (2)

- July 2024 (2)

- June 2024 (2)

- May 2024 (2)

- April 2024 (2)

- March 2024 (2)

- February 2024 (2)

- January 2024 (2)

- December 2023 (3)

- November 2023 (3)

- October 2023 (4)

- September 2023 (4)

- August 2023 (4)

- July 2023 (4)

- June 2023 (3)

- May 2023 (5)

- April 2023 (3)

- March 2023 (7)

- February 2023 (3)

- January 2023 (4)

- December 2022 (2)

- November 2022 (3)

- October 2022 (4)

- September 2022 (2)

- August 2022 (3)

.png?width=64&height=64&name=linkedin%20(1).png)