Share this

Challenges Faced by Meta's Metaverse Strategy

by Henry Chapman on October 27, 2022

Examining Facebook’s pivot to Meta and entry into the Metaverse

Facebook's Meta pivot fizzles

Reeling from scandals ranging from Instagram users’ mental health to Kenyan human trafficking rings on Facebook, in October 2021, Mark Zuckerberg announced his company would begin investing billions of dollars annually in its expansion to the Metaverse, or a social network based in virtual reality.

The initial announcement generated buzz that, according to consumer intelligence data, has fizzled out. Mentions of the Metaverse have dropped 34% thus far in 2022.

Meta mentions do not dominate Metaverse conversation

Despite tying the brand to the Metaverse-concept, social media users do not frequently mention Meta, Facebook, or Horizon Worlds when discussing it. Using an Infegy Atlas feature called Narratives, we found that posts focusing on Mark Zuckerberg-related entities only made up 2.93% of the top metaverse-related conversation, even after the company’s pivot. We found that mentions of cryptocurrencies and decentralization around virtual reality were much more common.

Concerning post volume around Meta’s Horizon Worlds

Meta’s flagship Metaverse offering is Horizon Worlds, an immersive, 3D social world where users can interact with others all over the world. Horizon Worlds launched in December 2021 after a long beta-testing period. Despite Meta’s extensive financial backing, Horizon Worlds post volume has only increased 22% within the last year. This declining post volume corroborates disappointing user growth from Meta. Meta had originally hoped for 500,000 active users by the end of 2022, but had less than 200,000 by mid-October.

Concerning post volume around Meta’s hardware launch

Unlike a traditional social network which just requires a phone or computer, the Metaverse requires consumers to purchase additional virtual reality hardware, which can often be quite expensive. Meta’s Reality Labs launched their newest offering, Quest Pro, in early October 2022. This headset has garnered a lukewarm reception. Infegy Atlas only recorded 31,529 mentions of Quest Pro on launch day, with that number quickly dwindling to 0.

For comparison, Apple’s purported AR goggles, which have not been announced or released yet, garnered 2.75 times the post volume of Meta’s Quest Pro.

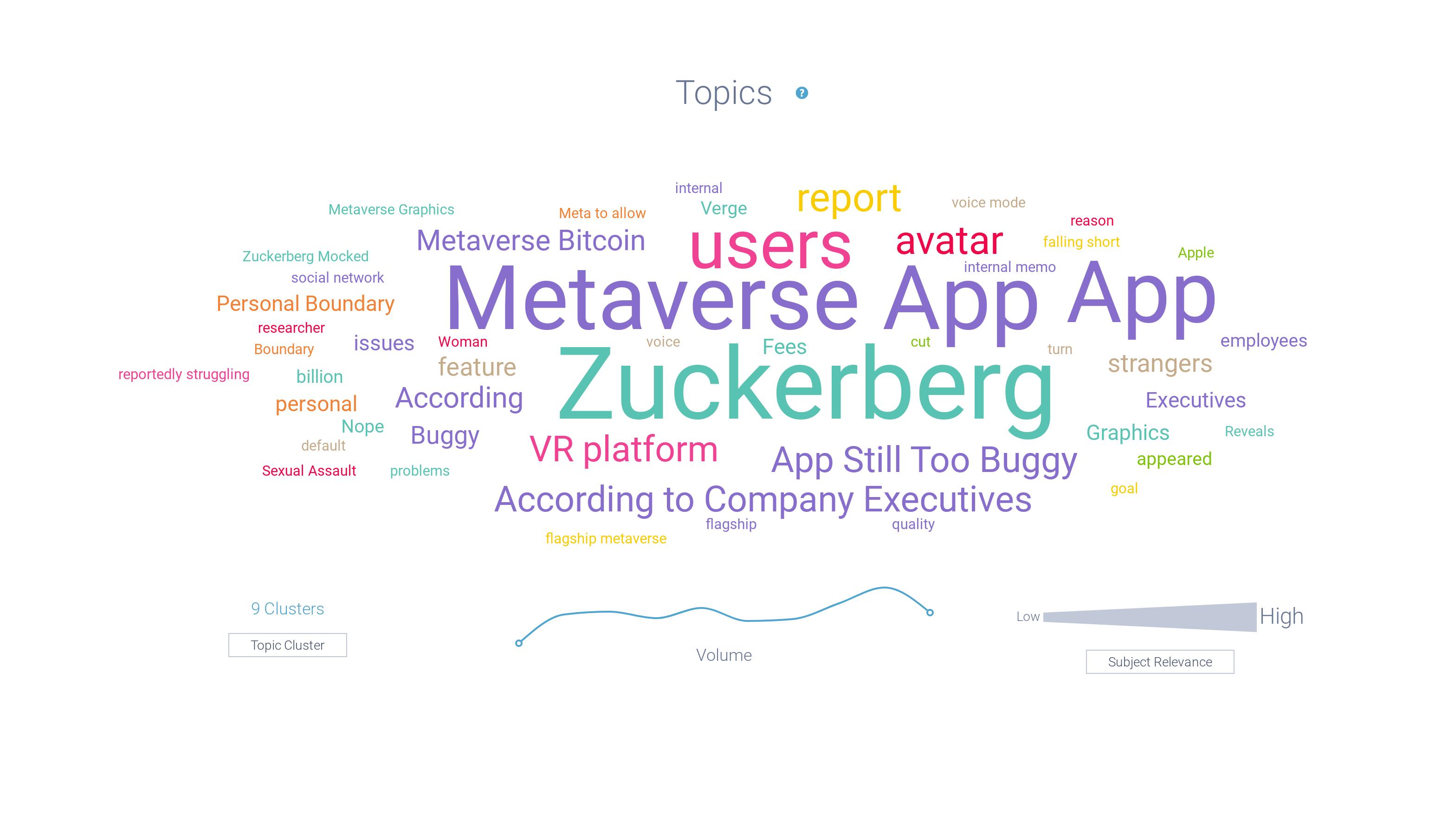

Using Infegy Atlas to identify pain points

We used Infegy Atlas to identify four pain-points potential customers had with Meta’s Metaverse concept. We found that early users complained about poor graphics, the extensive prevalence of sexual assault and adult content, the exorbitant cost, and the demographic imbalance associated with the platform.

Users complained about poor graphics

First, users complained extensively online about the primitive graphics associated with Meta’s Metaverse. Mark Zuckerberg posted a screenshot of the game on his personal Facebook page, and was mocked extensively online. Users said it looked like an avatar from a video game straight from the early 2000s. Users also complained that the avatars in Horizon Worlds lacked legs.

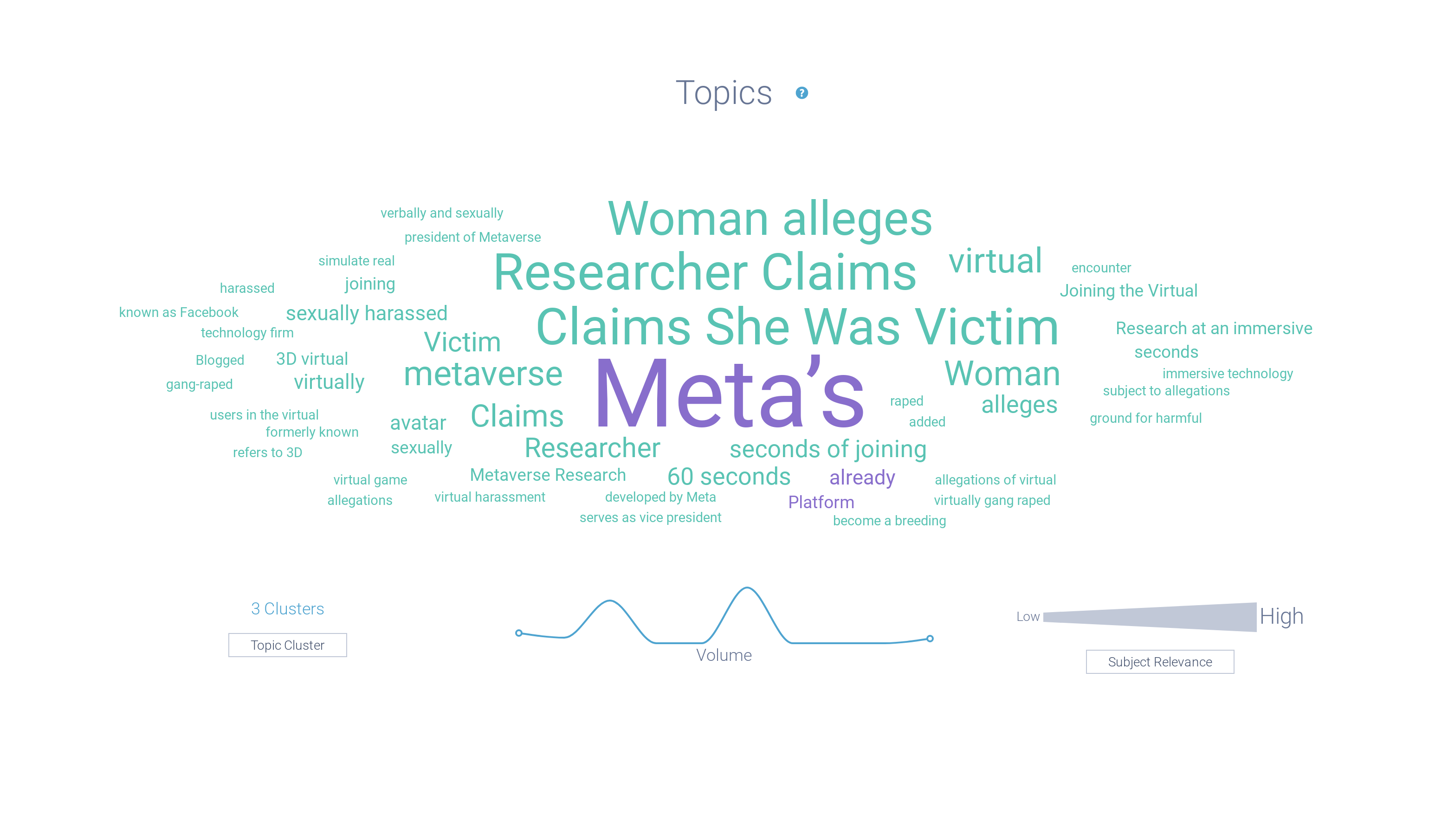

Sexual assault content and adult material

Secondly, users found a high preponderance of adult material on Horizon Worlds. This is especially concerning considering that children are allowed on Meta’s platform. One researcher claimed she was virtually assaulted by a group of men within sixty seconds of joining a virtual world. Meta has tried to pivot to these challenges by instituting a mandatory “boundary” around avatars, but the internet has remained skeptical that Meta will be able to keep inappropriate content off the platform.

Pricing concerns add friction to growth

Third, analysts have found Meta’s pricing adds friction to Metaverse growth. Traditional social media only requires a computer or a smartphone. These items are ubiquitous in society, so they don’t require consumers to purchase additional equipment. The Metaverse, on the other hand, requires users to make a minimum $400 purchase on Meta’s Quest 2 or spend $1499 for the more premium Quest Pro. Many users aren’t willing to spend that much for an experimental platform that’s still in development. Equally concerning are customers who paid for headsets but no longer use them. The Wall Street Journal found that more than half of all VR headsets aren’t in use 6 months after purchase.

Meta’s demographic imbalance

Lastly, Meta’s Horizon Worlds does not reflect the demographic balance of the world it’s supposed to mirror. Meta’s objective around Horizon Worlds, and the Metaverse in general, was to create a virtual reflection of the physical world. Infegy Atlas shows that this is not the case. Male post volume was more than twice as high as female post volume. Additionally, Infegy Atlas shows a skewed age distribution as well. Our stats mirror Meta’s usage statistics which show a similar imbalance.

Why should your brand care about this?

Meta has sunk over $10 billion into the Metaverse thus far, with major brands piling on. For example, Gucci built virtual stores and Louis Vuitton developed an immersive video game. A good social intelligence platform like Infegy Atlas could have made brands aware of the risks and poor usage statistics before investing their hard earned brand equity in a risky and potentially flailing venture.

Facebook's Meta Pivot Fizzles

Initial buzz around Meta's Metaverse launch has decreased, with mentions dropping 34% in 2022. Ongoing scandals and low user numbers raise concerns.

Meta Lags in Metaverse Conversations

Meta is not a dominant topic in Metaverse discussions. Cryptocurrencies and decentralization are more frequently mentioned, indicating a shift in user interests.

Disappointing Horizon Worlds Growth

Despite heavy investment, Horizon Worlds user and post growth remain low, with less than 200,000 active users against a target of 500,000 by 2022 end.

Underwhelming Quest Pro Launch

Meta's Quest Pro VR headset launch received a lukewarm response, with mentions rapidly decreasing, highlighting challenges in consumer adoption of VR hardware.

Share this

- January 2026 (2)

- December 2025 (2)

- November 2025 (2)

- October 2025 (3)

- September 2025 (2)

- August 2025 (2)

- July 2025 (3)

- June 2025 (3)

- May 2025 (4)

- April 2025 (2)

- March 2025 (1)

- February 2025 (4)

- January 2025 (1)

- December 2024 (2)

- November 2024 (2)

- October 2024 (4)

- September 2024 (2)

- August 2024 (2)

- July 2024 (2)

- June 2024 (2)

- May 2024 (2)

- April 2024 (2)

- March 2024 (2)

- February 2024 (2)

- January 2024 (2)

- December 2023 (3)

- November 2023 (3)

- October 2023 (4)

- September 2023 (4)

- August 2023 (4)

- July 2023 (4)

- June 2023 (3)

- May 2023 (5)

- April 2023 (3)

- March 2023 (7)

- February 2023 (3)

- January 2023 (4)

- December 2022 (2)

- November 2022 (3)

- October 2022 (4)

- September 2022 (2)

- August 2022 (3)

.png?width=64&height=64&name=linkedin%20(1).png)