Share this

How to power up your market research with a combination of social intelligence and traditional research

by Infegy Research Team on May 15, 2023

Every day, millions of people share their unsolicited opinions on virtually every topic under the sun via social media. From products and services to politics, activism, workouts, beauty tips, and more, if you’re looking for honest, real-time feedback, social listening is a great place to start.

However, this incredibly valuable source of insight remains untapped when it comes to market research. If you’re still relying solely on traditional research methods such as interest groups, polls, and surveys, you’re probably leaving thousands – if not millions – of readily available data points (and dollars!) on the table.

When combined with traditional market research methods, social media intelligence provides powerful insight into your target market.

Here, we provide five tips to help you elevate your market research by harnessing the power of social listening.

1. Use social intelligence to cross-examine market research for better results.

Traditional market research uses surveys, reviews, polls, and focus groups to understand how consumers feel about certain issues. While the data gained from these traditional methods can be valuable, it is often time-consuming and expensive to collect. These data sources also require large groups of participants in order to collect enough data to draw applicable conclusions.

The good news? Adding organic consumer perspectives to the research mix allows you to gain real-time insights and validate the findings of your traditional research methods.

We have a couple examples for you.

Comparing Rotten Tomatoes ratings to Infegy social listening data

If you’re an avid movie-watcher, you’re probably familiar with Rotten Tomatoes, a website that lists the aggregate rating for a given program or movie based on reviews provided by viewers.

We wanted to know how Rotten Tomatoes’ reviews compared to real-time, consumer reactions shared online. To do this, we compared social listening data – specifically, sentiment analysis of posts– to Rotten Tomatoes’ more traditional approach of collecting formal viewer reviews and ratings. Our target program? The very popular Game of Thrones.

When it came to consumer sentiment towards Game of Thrones, we found that social listening sentiment analysis was a leading indicator of Rotten Tomatoes reviews (Figure 1).

Figure 1: Game of Thrones consumer sentiment analysis, Rotten Tomatoes vs. Infegy social media sentiment; Infegy Atlas data, 2014-2019.

For instance, take a look at feedback regarding Season 8 (the red vertical line). Overall, viewers did not like this season. However, you can see that social media sentiment began to tank even before Rotten Tomatoes registered a drop.

In other words, social listening provided consumer insights and reactions to Game of Thrones sooner than Rotten Tomatoes did. This happens because viewers have a tendency to take to social media right away to voice their opinions, while they may wait until they’re done with the whole season before writing a Rotten Tomatoes review. You may be wondering, “Why bother combining the two approaches when social listening data offers more immediate insights?” Good question!

The benefit of combining the two approaches is that social listening provides reactive, virtually immediate customer sentiment feedback, which can then be validated by the slower, yet (arguably) more thoughtful, less reactive Rotten Tomatoes reviews.

This example illustrates that if you want fast and immediate insights into what your customers are thinking and feeling, consider integrating a social listening strategy as part of your market research. Follow-up by validating the results with trailing online reviews.

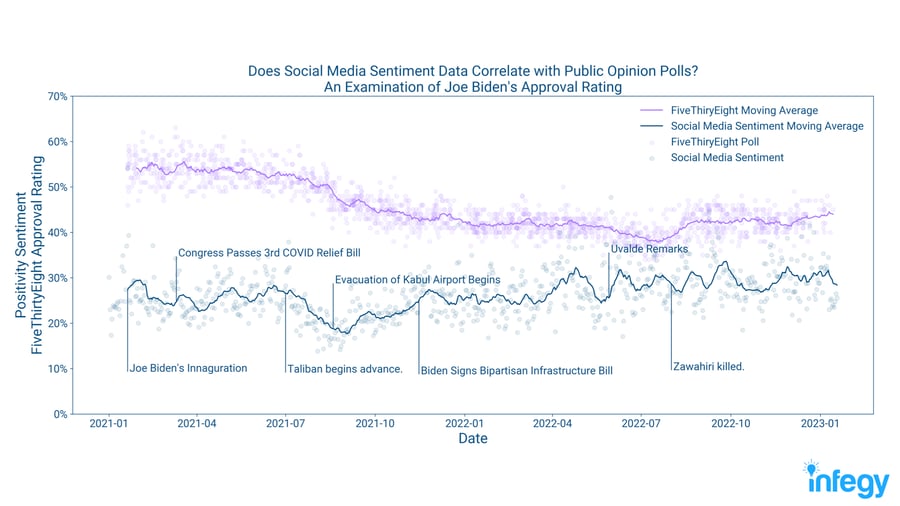

Comparing Joe Biden’s approval rating (public opinion polls) to Infegy social intelligence data

Social listening isn’t only helpful for consumer brands. Political pollsters can also benefit from keeping an ear to social sentiment. Here, we compared the moving average of U.S. President Joe Biden’s FiveThirtyEight approval rating with Infegy Atlas’s social media sentiment data. (Figure 2).

Figure 2: Insight into Joe Biden’s approval ratings, FiveThirtyEight political polling data vs. Infegy social media sentiment: Infegy Atlas data, January 1, 2021 through January 1, 2023.

Figure 2: Insight into Joe Biden’s approval ratings, FiveThirtyEight political polling data vs. Infegy social media sentiment: Infegy Atlas data, January 1, 2021 through January 1, 2023.

An analysis of this data uncovers two correlated trends (with an R-squared value of .55):

- Joe Biden’s approval rating (shown in purple in the figure above) begins to drop when the Taliban took over Afghanistan.

- Infegy’s social listening sentiment analysis shows a drop during the same timeframe.

This example shows how social listening data can be helpful in supporting more traditional forms of market research, such as political polling.

2. Discover product attributes that resonate with customers.

In today’s age of data and connectivity, you’d think that businesses would have a deep understanding of what their customers want and how those customers are using the company’s products.

However, that’s far from true.

The truth is that many companies that spend a lot of time and money conducting focus groups to acquire marketing and R&D insights and still, they come away without a firm grasp on their target audience’s needs and desires!

While focus groups definitely have their place, social listening is a more affordable and faster way to gain specific insights into your consumer’s needs, pain points, and interests.

Let’s look at a couple examples.

Social listening sentiment among parents discussing the Toyota brand

Let’s take a look at social media data – specifically, the sentiment analysis – of parents posting about Toyota vehicles.

Without knowing for sure, you might assume that conversations among parents would revolve around the brand’s popular minivan, the Toyota Sienna. However, a hashtag analysis of the conversation resulted in an overwhelming number of off-roading-related topics, indicating that it’s Toyota’s off-roading vehicles that really resonate with this demographic (Figure 3).

Figure 3: Hashtags often associated with parents discussing Toyota, colorized by sentiment analysis metrics; Infegy Atlas data, February 2023 through April 2023.

We conducted an Infegy Interests analysis of this demographic to see what else they discussed frequently (Figure 4). We found higher positivity related to larger Toyota SUVs and more rugged off-roading vehicles (Toyota Tundra, 4Runner, Tacoma), as compared with smaller Toyotas and other brands.

Figure 4: Interests analysis – vehicle-related interests among parents discussing the Toyota brand; Infegy Atlas data, February 2023 through April 2023.

According to the social listening findings reflected in Figures 3 and 4 (that Toyota’s off-roading vehicles resonate with the brand’s consumers who are parents), we now have data showing that Toyota probably should focus on marketing their SUVs to parents. We also have evidence to support that Toyota R&D should continue their efforts in developing and improving their off-roading vehicles – perhaps with greater safety and comfort features that would be interesting to parents – since there is avid interest and a market for them.

We acquired this data within moments, without the high cost and time burden of a focus group or survey and analysis process. You could include survey data or a focus group for additional validation but a social listening platform will get your team more than halfway to the finish line, and fast!

The bottom line? Using social media listening to learn more about customer interests and sentiment can elevate your brand’s marketing and allow you to develop products that better resonate with your target markets.

In fact, you can use a similar process to strengthen your content marketing strategy as well – it all begins with knowing and understanding your target audience.

Related: Learn how social listening can help elevate your sales pitch.

3. Make data-driven recommendations to improve your brand’s reputation.

If you’re searching for real-time data to understand how your customers feel about your brand at any given moment, social listening may be the answer.

A social listening platform can be a valuable tool in gauging how your customers are reacting to events outside of your control, such as negative publicity.

Also, if you’re planning to take your brand in a new direction or make a big corporate announcement, you’d be wise to continuously monitor the reaction of your target audience. This gives you a headstart on managing brand-damaging situations.

The consumer responses to changing features on Instagram offers a great example of why the intelligence gained through social media is so important.

Meta and #MakeInstagramInstagramAgain: Understanding what consumers really need from your brand

Meta’s Instagram has a history of copying other apps’ core features. This worked out well for the social media platform in 2016 when it adopted its own version of Snapchat’s “Story” feature. However, in July 2022, their copycat strategy backfired when Instagram tried to introduce a version of TikTok’s short-form video feature by placing full-screen video over the app’s traditional image feed.

Immediately following the feature’s release, social listening platforms detected a huge surge in past volume that consisted mostly of user complaints. Instagram user @illumitati shared a post calling on Meta to “Make Instagram Instagram Again.”

Figure 5: Screenshot of @illuminati’s July 2022 Instagram post.

The post quickly gained traction and retweets by the Kardashian siblings on July 26, 2022. The retweets further accelerated online discussions related to the brand, driving up post volume around the issue (Figure 6).

Figure 6: Post volume analysis showing spikes around the #MakeInstagramInstagramAgain movement; Infegy Atlas data July 17, 2022 through August 11, 2022.

A keyword analysis provided insight into the topics and sentiment of these posts. Instagram users discussed the issue using terms such as “sign the petition,” “stop trying,” “video,” and “trying to be TikTok” (Figure 7). This shows that much of the conversation was about people’s frustration with the new update.

Figure 7: Keywords associated with posts related to Instagram’s short-form video rollout; Infegy Atlas data, July 2022.

User insights gained through social listening were clear – Instagram users wanted a photo-sharing platform, not another short-form video app. Because Instagram was monitoring user sentiment on social media, it was able to quickly reverse course and revert back to the user experience brand loyalists had come to know and love. As a result, online chatter quickly calmed down again and users continued with their normal behavior.

This example highlights how social listening provides the quick but vital insights you need to understand not just what your consumers want, but what they rely on your brand to fulfill. In this case, Instagram users don’t want another TikTok; they want the unique user experience of Instagram.

The Instagram example also highlights the importance of having access to real-time consumer sentiment data. Without this information, it may have taken the brand significantly longer to adjust to negative consumer feedback. By the time polls, reviews, and online surveys would have caught up to user feedback, it’s possible the negative sentiment would have already caused irreparable damage to Instagram’s brand and customer loyalty.

Related: Make Instagram Instagram Again (Insight Brief).

4. Identify and activate key influencers

Once you have identified the target audience for your product or service, social listening can be a great way to identify and activate key influencers with sway over them. Insight into demographics, interests, and behavior can allow you to better predict what particular influencers your customers are likely to follow and engage with.

Fashion and beauty influencers

Let’s assume your market research indicates that your target audience is mainly composed of younger women who are interested in fashion and beauty.

(You may not even be in the fashion or beauty industries, but if your target audience has an interest in them, then you need to identify influencers who have a high level of engagement with young women – particularly those whose interest in fashion and beauty is likely to overlap with interest in your brand.)

Sephora is a well-known, trusted beauty brand, so we researched influencers that appeared in the context of Sephora using the hashtag #BeautyBlogger. We targeted smaller influencers because our past research has shown that social media users are more likely to trust them over mega influencers such as Kim Kardashian. (This is likely because smaller influencers come across as more authentic and take more time to interact with their followers.)

Our research yielded the following top influencers for Sephora and #BeautyBlogger (Figure 8).

Figure 8: Analysis of top influencers for both Sephora and #BeautyBlogger; Infegy Atlas data, February 2023 through April 2023.

Using social listening results like these in combination with market research surveys and focus groups can help your brand more accurately identify the social influencers who can move the needle on your marketing efforts.

Social listening intelligence around influencers can also help you evaluate the effectiveness of an influencer campaign by offering insights into key metrics, such as engagement rates, reach, and conversion rates. By monitoring these metrics, you can easily identify which influencers are driving the most engagement and sales, and adjust your influencer marketing strategies accordingly.

Related: Boost your experiential marketing efforts with our free eBook, Experiential Marketing that Captivates and Converts.

5. Link brand loyalty or defection signals to the marketing funnel.

Having trouble gauging brand loyalty among your customers? Social listening data can help you gain a better understanding of customer trends within your target market. This can be helpful in identifying when your brand is successful at attracting customers, as well as when your brand is losing customers. The real-time application of social listening data allows you to see exactly what actions are keeping customers happy and what actions may be driving customers away.

Let’s look at Netflix as an example.

Policy changes and Netflix’s churn risk

When the media company first pioneered video streaming in 2007, it prided itself as a brand that was accessible to everyone. In 2017, the company went so far as to tweet, “Love is sharing a password,” clearly indicating its approval of account sharing.

Figure 9: Screenshot illustrating Netflix’s previous support of password sharing; Twitter, March 10, 2017.

However, rising interest rates, new competitors in the streaming space, and a declining share price have forced Netflix to look for ways to increase revenue. One of their action points was to crack down on password sharing.

We used social listening to track consumer responses to this policy change.

In April 2023, Netflix announced specific plans for cutting back on account sharing by July 2023. Post volume spiked following this announcement (Figure 10).

Figure 10: Post volume analysis showing a spike following Netflix’s confirmation that it would crack down on password sharing; Infegy Atlas data, July 17, 2023 through April 17, 2023.

Netflix first rolled out its new anti-password-sharing policies in South America, where users’ responses were overwhelmingly negative (Figure 11). The most common complaints related to a need to regularly connect to a home WiFi network in order to continue streaming.

Figure 11: South American sentiment around Netflix’s new password sharing policy, Infegy Atlas data (February 2023).

A related analysis shows that frustrated Netflix customers are increasingly discussing other ways to access streaming media, including digital piracy. Infegy Atlas data shows us that conversations around illegal downloading have surged more than 1000% since Netflix cracked down on password sharing in South America (Figure 12).

Figure 12: Interests around those complaining about Netflix’s password sharing; Infegy Atlas data (February 2023).

Negative sentiment and a spike in posts related to piracy are strong indicators that current customers may choose to defect rather than be subject to the new requirements.

The Netflix example illustrated how social media data offers vital consumer insights that could alert your company or brand to customer churn. Use social listening to monitor responses to big policy or brand changes, avoid alienating customers, and to guide decision-making.

Related: The Cost of Netflix’s Crackdown (Insight Brief).

Make social intelligence your first stop to actionable market research

The bottom line? If you’re looking to take your market research to the next level, incorporating social listening strategies with more traditional research methods may give you the boost you need.

The data provided by the Infegy Atlas social listening platform offers valuable insight into audience sentiment, interests, pain points, and desires. Use them to level up your research for marketing, strategy, and development!

To learn more about how our social listening intelligence can enhance your market research efforts, request a custom demo today!

Key Takeaways

1. Social listening provides faster, real-time insights compared to traditional research methods. The examples show that social media sentiment often appears as a leading indicator before traditional methods like polls, reviews, or surveys catch up. This speed advantage lets brands respond quickly to consumer feedback and emerging trends.

2. Social intelligence validates and enhances traditional market research when used together. Rather than replacing focus groups, surveys, and polls entirely, social listening works best as a complementary tool. It offers immediate reactive data that can then be confirmed by more thoughtful traditional methods, giving you both speed and validation.

3. Social listening reveals what customers actually care about versus what brands assume. The Toyota example perfectly illustrates this—instead of assuming parents would discuss minivans, the data showed they were far more interested in off-roading vehicles. This kind of insight helps brands make better decisions about product development, marketing strategies, and resource allocation without the time and expense of traditional research.

Share this

- February 2026 (2)

- January 2026 (1)

- December 2025 (2)

- November 2025 (1)

- October 2025 (1)

- September 2025 (1)

- August 2025 (2)

- July 2025 (2)

- June 2025 (1)

- April 2025 (4)

- March 2025 (4)

- February 2025 (2)

- January 2025 (2)

- December 2024 (1)

- November 2024 (1)

- October 2024 (2)

- September 2024 (3)

- August 2024 (4)

- July 2024 (2)

- June 2024 (1)

- May 2024 (2)

- April 2024 (2)

- March 2024 (3)

- February 2024 (3)

- January 2024 (2)

- December 2023 (3)

- November 2023 (4)

- October 2023 (3)

- September 2023 (3)

- August 2023 (4)

- July 2023 (4)

- June 2023 (2)

- May 2023 (4)

- April 2023 (4)

- March 2023 (4)

- February 2023 (4)

- January 2023 (1)

- December 2022 (3)

- November 2022 (4)

- October 2022 (3)

- September 2022 (3)

- August 2022 (2)

- July 2022 (1)

- June 2022 (1)

- April 2022 (1)

- March 2022 (1)

- January 2022 (1)

- December 2021 (1)

- November 2021 (1)

- October 2021 (1)

- June 2021 (1)

- May 2021 (1)

- April 2021 (1)

- March 2021 (1)

- February 2021 (1)

- January 2021 (2)

- November 2020 (1)

- October 2020 (2)

- September 2020 (1)

- August 2020 (2)

- July 2020 (2)

- June 2020 (2)

- April 2020 (1)

- March 2020 (2)

- February 2020 (2)

- January 2020 (2)

- December 2019 (2)

- November 2019 (1)

- October 2019 (1)

- September 2019 (2)

- August 2019 (2)

- July 2019 (1)

- June 2019 (1)

- May 2019 (2)

- March 2019 (2)

- February 2019 (2)

- January 2019 (1)

.png?width=64&height=64&name=linkedin%20(1).png)